Do you ever wonder if your medical practice needs a chief financial officer? What if you could have the strategic financial guidance without the full-time executive price tag? Today’s guest explains how fractional CFOs are helping healthcare practices thrive while letting providers focus on what matters most, patient care.

This is episode #166 of the Thriving Practice with Tracy Cherpeski featuring Lizette Peña, Fractional CFO at Ascent CFO Solutions.

Introduction

**Tracy:** Welcome to Thriving Practice, the podcast for healthcare providers who are masters of two worlds, exceptional patient care, and savvy business ownership. I’m your host and guide, Tracy Cherpeski. If you have ever felt like you’re running a three-ring circus instead of a medical practice, you’re in the right place. We understand the unique challenges you face, the constant balancing act between providing top-notch care and managing the business side can leave you feeling stretched thin, perhaps questioning your decisions and even wondering if this is really what you signed up for.

If there was a way to not just survive, but truly thrive, would you explore it? To feel energized about your practice, confident in your business acumen and deeply fulfilled in your career? Well, that is exactly what we’re here to help you achieve.

Each episode of Thriving Practice brings you conversations with successful healthcare entrepreneurs and industry experts who’ve navigated the same choppy waters you’re in. They will share battle-tested strategies to streamline your operations, boost your decision-making confidence, and reignite your passion for your work. From staff management and marketing to strategic financial planning to achieving work-life harmony and more, we dive into the practical insights you need to grow or scale your practice.

Our goal is to help you create the rewarding career you envisioned when you first hung out your shingle. So if you’re ready to stop merely keeping your head above water and start riding the wave of success, hit the subscribe button now. Join us on Thriving Practice, where we prove that outstanding patient care and business excellence are not mutually exclusive. They’re the perfect prescription for a fulfilling career. Welcome to Thriving Practice. It’s your time to turn your challenges into triumphs and your practice into a beacon of success. Let’s dive in.

Meet Lizette Peña, Fractional CFO

**Tracy:** Welcome back. It’s me Tracy. We have had several fractional CFOs on the show over the years because I believe their creative entrepreneurial approach to finance is exactly what healthcare practices need. Each brings their unique perspective and methodology, and today’s guest is no exception. Let’s be honest, you did not spend all those years in medical school to become a financial expert, yet as a practice owner, you’re expected to make critical business decisions while providing excellent patient care. That is where today’s guest shines.

Lisette Peña is a CPA with over 30 years of experience and is now a fractional CFO with Ascent CFO Solutions, a fractional CFO firm based in Boulder, Colorado. After years in public accounting and private industry, Lisette discovered her passion for helping mission-driven organizations use business as a force for good.

In this episode, we explore how fractional CFOs help healthcare practices thrive by providing high-level financial strategy without the full-time cost. Lisette shares practical insights on managing cash flow, understanding key performance indicators, and making data-driven decisions. She also explains why sometimes paying vendors quickly isn’t always the best strategy and how to balance the clinical and business sides of running a practice.

So whether you’re struggling to keep up with the financial demands of your practice or simply want to optimize your business operations, this conversation offers valuable insights for healthcare providers at every stage of practice ownership. What I particularly appreciate about Lisette’s approach is her understanding of the unique challenges healthcare providers face as entrepreneurs. So let’s dive into my conversation with Lisette Peña about using fractional CFO services to help your practice thrive.

**Tracy:** Lizette Peña, thank you so much for coming on the show. I’ve just so enjoyed chatting with you the last couple of minutes, so I’m excited to share your story. And welcome into the show.

**Lizette:** Thanks, Tracy. Yeah, it’s exciting to be here. And I’m happy to participate and share some wisdom.

What is a Fractional CFO?

**Tracy:** Awesome. Well, tell us about Ascent CFO solutions first. And then maybe tell us, you know, how you came to decide that being a fractional CFO is the path that you wanted to take.

**Lizette:** Yeah. Ascent CFO solutions is a fractional CFO firm. We’re based in Boulder, Colorado, but we serve clients all over the country. So it’s funny because I just started a new client this week, so now I officially have a client in three time zones. So it’s fun because most of my clients I have met in person, and so it’s really evolved to we can do a lot of work remotely, but we can also help our clients in person and go to their offices if that’s really what they need.

So I, my background is as a CPA. I’ve worked as a CPA for 30 years and I started my career in public accounting. So doing audits and tax returns and some business consulting and it was really when I started working with a particular client that was a worker owned cooperative and mission-based a certified B Corp that I really realized like wow there’s really a different way to do business and to actually use your business as a force for good and that was when I really left public accounting and went to work in a private company as their director of finance.

So as a fractional CFO, I’ve been able to combine my experience of working with inside a company as their director of finance and really knowing what goes on the day-to-day, managing cash flow, making decisions, risk-based and contracts and managing employees and teams and providing leadership support, as well as doing accounting. And that was something that I really didn’t understand just working in public accounting as an auditor, because you really only see the end product like the financials at the end of the year and you go once a year.

So that really helped me combine those skill sets of coming in once a year and really diving deep and quickly from a strategic standpoint and understanding the risks of an organization and then being able to apply recommendations and just some knowledge from those two viewpoints. So it’s really been kind of a fun marriage of those two skill sets that I’ve been working as a fractional CFO.

**Tracy:** What I’m kind of hearing is like when you get to combine the two, like I have an MBA, but I’m not an accountant, but my vague recollection of accounting is it’s, you know, a lot of times it’s historical and you don’t get to be as strategic, but it sounds like you also get to take like your understanding of how it works and apply that to the strategic side, you know, when you get to work with that, with your clients, with, you know, you’re talking about leadership support and, you know, with their teams and everything. So I would imagine it’s pretty fun. It sounds fun to me.

**Lizette:** Yeah, it’s sometimes I, we kind of joke, it’s like, wow, I didn’t know accounting could be so exciting. There are just sometimes that hard decisions need to be made or hard conversations need to happen. I think accounting has really evolved from what we all thought it was when we went to college and we were learning, you know, debits and credits and balance sheet and income statement. But that’s just the basics. Like with any profession, I suppose, that’s just really the foundation.

And it’s what you do with that information and really apply that to help your clients succeed. And really just knowing and seeing like, okay, well, I’ve seen this before, I’ve seen it work well. And then I’ve seen it also not work so well. And just really having that, that knowledge to be able to, that fountain of knowledge to be able to draw on.

And that’s the other cool thing about Ascent CFO is that it’s a team of about 30 of us. So we’re at different levels, we have folks from senior accountant, accounting manager, controller, CFO. So there’s just different levels that we can all help support each other. We’ve all worked with different industries. We have different focuses and we can say, hey, has anybody ever seen this issue or can anyone recommend a payroll provider? Like there’s just so much wealth of information that we help each other draw upon and can help our clients succeed with that knowledge.

Why Work With a Fractional CFO?

**Tracy:** I love that. And I think one of the things that I see supporting the clients that we work with when they bring in a fractional CFO is, yes, a provider owner is a business owner, but they often don’t have business training. And so, all of that responsibility for the business on top of the responsibility for the clinical side of the practice is huge. And there’s already enough pressure as there is.

And something that we’ve seen over the years, given the option between taking care of something that’s urgent or imminent clinically and something that’s urgent or imminent business-wise, they’re always going to default to clinical. So I’m curious if you can help explain for our listeners, like why would they wanna work with a fractional CFO? Like that sounds, it sounds big and it sounds expensive. So to, you know, why would it make sense to work with a fractional CFO as opposed to like maybe hiring somebody in and like we were saying as we’re warming up, you know, why can’t the practice manager just do this?

**Lizette:** Yeah, that’s a great question. And, you know, honestly, there’s some organizations that do better with a fractional CFO and some others that want to have a person in house. So let’s talk about those two different situations.

So the opportunities of working with a fractional CFO really gives you access to someone that has a varied skill set, right? So we have a whole team of a fractional CFO. People have different focus points and different backgrounds, like so many, many years to draw upon. Whereas if you just hire one person, you have that one person’s background that’s going to be on your team. Now that’s not to say that there’s anything that’s detrimental, but again, you’re just kind of limiting your advice that you’re getting from that CFO just to that one person.

But the other thing about working with a fractional CFO is that it’s, you have more time, right? So you’d think that there’s limited time because this person is only going to be working on your account, you know, a certain amount of hours, but the focus time that you’re going to get from that person is pretty dedicated. And you can kind of rely on that.

And so what we usually do with our clients is we’ll have weekly check-in meetings. So there’s always something that recurs. And so you always can plan for that. You kind of eliminate the back and forth with a lot of questions or emails throughout the week. Like you could save things that are not urgent or imminent and talk about those in your weekly discussions. I like to have one on one specifically with the CEO or the practice director because there’s usually conversations that you want to have with just that person. And then it’s also important to be part of an accounting team meeting that whether you’re either managing that practice’s accounting team for them or if you also have a fractional accounting team.

So everyone’s staying on point with deliverables, deadlines, reports, KPIs and information that the practice manager needs to have on a timely basis. So it’s really staying put with deadlines and appointments that you have set because I think as a fractional CFO, we’re managing several clients. So you have to work in a cadence as opposed to, I mean, I know when I was working as the director of finance, you kind of get pulled in 100 different ways, and then you had your HR hat on, and then you had other things that you got drawn into.

So I think it’s a little bit easier for me as a fractional CFO to be able to have those boundaries, and the client is more willing to have those boundaries for you, right? Because they don’t want you spending time working on things that maybe you can help, but maybe it’s not really what you’re best suited for. So it helps have clearer boundaries with what you’re here to help with, and you can really focus on that skill set and provide that value for them.

And the other thing about a fractional CFO is that sometimes you can monitor or control the number of hours that you’re working with a client. Like usually when I start working with a client, there’s a lot more hours at the onset, right? You’re trying to get to know everyone on the team and really dig around and figure out what’s going on. Where can I really provide value?

And then once you get that cadence going, sometimes there’s another professional that I could bring in that maybe be at a lower rate, right? because my goal will be to provide the most value and to work at a level that is best suited for the client to be very conscious of cost because that’s, you know, any money that is going to go towards any outside fees is really money that needs to be allocated properly and just included as part of a budget. So, yeah, so it kind of helps to have that, the differentiation.

Key Financial Metrics for Healthcare Practices

**Tracy:** I mean, I think there’s so much value in that, right? And even it speaks to your integrity to say, like, hey, there might be somebody who I can bring in at a lower rate who’s going to get the things, you know, once you understand what your client needs to get the proper things done, still have high value and still be mindful of cost. I mean, of course, we want our numbers people to be mindful of cost, but it doesn’t always work out that way, right? So I’m sure that that’s encouraging to our listeners to hear like, oh, so it doesn’t have to cost an arm and leg to do this.

You mentioned KPIs. And I’m curious about what are some of the metrics and KPIs that specifically a medical or health care practice owner wants to really know so that they can go and take a look at them, obviously, maybe even prepare in advance for your weekly meetings. But to have a really good handle on so they know how to make strategic decisions.

**Lizette:** Yeah, that’s a great question. And a lot of that’s been evolving. And I feel like that’s one of the things that I was able to do when I start with a new client. It’s always good to put fresh eyes on things. So just like, what have we been getting information on? What have been or what of our metrics, are they even relevant anymore? And so really taking a look at that.

And what I’ve found for the practices that I’ve been working with, and again, different practices are going to have different needs, right? Like if you compare a dermatology practice to a low-income clinic, you’re going to have different metrics, right? Because one is going to be more revenue. It’s going to have higher revenues. The other clinic is gonna be dependent on grants and other types of funding.

But from just a patient-centric type metric, I would say that one of the things that’s really been helpful for my clients is really looking at your cancellation and no show rates and understanding like, why are we having these blocks of time that were set for these appointments and then the folks aren’t showing up. And so that really helped us dig into, and again, this is nothing to do with accounting, has more to do with business, but it helped us understand that we needed to get better at the prepatent check-in, like following up and reminding people.

And I know we all hate to get those robo calls about the appointments, but I finally understand like why it’s important because a missed appointment is a missed revenue opportunity for our practices. So really ensuring that we have a handle on why do we have what is our cancellation rate and no show rate? How does that trend out? Is it relevant to the time of year? Do you serve a lot of teenagers or students that maybe in the summer you’re going to see more or less of them because they’re on vacation or not? So those kinds of things really help you understand your staffing and just how you’re doing with your patient service.

The other thing that I think is important to know is what your payer mix is. And again, this may not be relevant for all types of practices, but if you’re accepting insurance, it’s really helpful to know, what is my mix of Medicare/Medicaid patients? What is my mix of private pay patients, and then how many patients are we seeing that are just paying their own bill? And why does that matter? Well, because it kind of matters of how much money you’re going to be able to generate from those visits and how you’re filling up those appointments. So really understanding the payer mix. And that also triggered for us like, “Hmm, maybe we need to look at or contracts with our payers, our insurance companies, to make sure that we were current and billing as much as we could possibly get paid by these insurance companies.

**Tracy:** Yeah, and stay on top of that because it changes frequently, right? And insurance, I mean, I have yet to work with anybody or speak with any provider who’s like, you know what I love the most is the insurance structure, right? So, but it is what it is. It’s the system that we have, you know, to work with. So it’s really important, you know, we recently interviewed somebody who’s very, very specific niche specialty is coding and just how incredibly important it is to hire a professional who’s a certified coding professional, right? And like to the tune of millions of dollars left on the table if things are done correctly, right? So I think this is the biggest headache that we hear from most of our clients, too. It’s like, “Oh, start talking insurance in their eyes roll and their steam comes out their ears,” you know.

**Lizette:** Right. And I think that’s when you said it correctly. It’s like you really want to have someone on your team that’s really good at that, that knows what they’re doing. And I think there’s a whole other set of KPIs for that whole team, which is the revenue cycle management team, right? So that’s going to be like the claims denied. Can you track that? Are we getting better at this? Are we seeing the same types of reasons coming up for our claims getting denied? And then also just collections like days to get paid. That all gives you insight into how are we doing with our revenue cycle.

Cash Flow Management Tips

**Lizette:** Yeah. So those are all specific to practice areas, but there’s also some KPIs just for general business purposes that I think are important for healthcare practitioners to keep an eye on. And one of those, which is one of the other things that I noticed when I first started working with a recent client, was how quickly you were paying your payables. Like, you know, if you’re accepting insurance, it’s going to take a while, right? It’s going to take a month or however long or 90 days sometimes to get paid. But you really want to try to marry your payments out to your vendors to match the timing of when the money’s coming into the practice so that you’re not…

And I’ve seen it even with non-clinical practices. I’ve seen it with construction and another industries where we’re so anxious and we want to pay our vendors on time, which is so great and very admirable. But you have to be careful that you’re not paying too quickly, right? And then you’re sending out all your cash and then it’s a struggle to meet payroll. So really managing that cash flow, understanding your cash flow is and what’s your cash burn for the month.

Understanding that and then working with that accounting team so that they’re really managing their payables like if somebody if your vendors giving you 30 days to pay take it. It’s okay, right if they’re giving you 60 days to pay really it’s okay to take 60 days to pay because it’s because as long as it’s not costing you interest or anything like that, but I’ve just seen time and time again where folks kinda like the accounts payable, folks just wanna get it off their plate, they wanna get it paid. But then you have other constraints, right? Now you’ve used that money and maybe you needed to use it to stock up on some pharmacy supplies or anything like that. So you really wanna be able to have your CFO to be able to have a handle on on what your cash flow is and managing that properly.

**Tracy:** If there’s anything I’ve seen in my nearly 15 years of doing this, it has been so much fear around money, fear or scarcity or wanting to hide and run away from it. But it’s so, what I’ve seen happen with our clients is it’s so empowering to understand how it all works because then the stress levels come down and clear thinking comes through, better decisions are made. Sometimes they end up recovering more and ending up with a better profitability in the long run.

I can imagine that it’s like a soothing bomb at some point, maybe not in the beginning, but once you get into that cadence that you were speaking of that you must see your client’s stress levels just drop and come and confidence increases. This is something that you see a lot too, is like it’s hard to be a provider and a business owner. Those are two very different hats to be wearing and there’s often less confidence with the business side.

**Lizette:** Yeah, definitely. I mean, it’s just not, it’s not everyone’s skill set, right? We can’t do all these things. And that’s really one of the things that I’ve seen like a difference between those practices and even businesses in general that succeed is those leaders that realize that and that’s okay. And then they delegate and trust in those others to help support them in those areas that maybe they either don’t have time or just don’t have the skill set to really manage that. I mean, that’s why we all a diverse workforce is so important because we also bring something different to the table.

Overcoming Resistance to Fractional CFO Services

**Tracy:** I would imagine that your clients, do you ever like when you first meet with someone have they already decided or are they kind of like yeah, I don’t know I heard about this or somebody said I should talk to you and you know, do you do you get resistance?

**Lizette:** Yeah. Yeah, we do. And actually, it’s sometimes not only on the offset at the beginning, sometimes it continues, right? I think, like you said, I think there’s a lot of fear around money and some of the discussions. Like, unfortunately, you know, it’s like, I feel like, why do I, why am I always the one that’s bringing this bad news? I feel like, but it’s not bad news, right? It’s really just informing what the facts are and how are we going to react or what are we going to do with this knowledge?

So I feel that we get different types of clients. Some have already made up their mind that they want to work with a fractional CFO and they come with a referral from another client that’s had a really good experience. And then others just are at a point where their CFO internal has just left and now they have no other place to turn. We’ve seen both extremes.

And so really, it’s just important to build that trust from the beginning and to listen, which is what I try to do is like to listen to what are the issues that they’re trying to solve. What are the problems that they’re carrying that they don’t need to anymore because they have other things to worry about and that they can like hand that off and say here, Lizette, I need you to help me with this and I need to know that it’s in good hands and I don’t need to worry about it anymore.

And so that’s really when I think the relationship and the bond can form when that CEO or that practice director has that trust and that openness to share. What are the concerns? Because if there is a closed personality or they don’t feel like this is going to work or anything like that, then that’s going to become a difficult relationship. It’s like with anything, right? You’ve got to have that trust from the beginning on both parts that you’re telling me everything so that I know all facts and then I can make the best decision for the organization and then guide you to make your best decisions. And that’s really just a win-win situation, working together, trusting, and then asking questions.

Letting Go and Focusing on What You Do Best

**Tracy:** Yeah. I think it’s also important to just remind our listeners that just even if you’re pretty business savvy and you’re finance savvy, your brother’s a CFO and informs you or whatever, this is all well and good, but just because you could doesn’t mean that you should. And I think this is a really big key piece to send home from my perspective is if you want to keep loving what you do, you do not do it 24 hours a day.

It’s important to be able to turn it off at the end of the day. And if you’re going home and you’re working on your financials or you’re still charting or whatever and your day becomes a 16 or 17 hour day at some point that will catch up with you in a not positive kind of way. And one of the keys to what we want for our clients and what we want for our listeners is that freedom.

One of the reasons that any business owner goes out on their own, but especially providers who go out on their own, is because they were looking for the freedom. And It’s many things, oftentimes it’s control over their time or control over their earning capacity or an ability to spend more time with patients, to be more patient-centric. And I promise you that letting go of some of these duties and handing them over to a very capable professional or a team of professionals will buy you so much more brain space and so much more energy that it will, at the at least it’ll come out in the wash, but most of the time you come out ahead financially for it. And if it’s not the money you’re concerned about, then think about your trust, your energy and your stress levels.

**Lizette:** Perfectly said. Yep, I see that all the time. It’s just, you know, it’s difficult, right? Because you’re said, you’re doing, this is your baby. It’s your own business. You want this to work, and you want it to go in a certain way, and that’s okay. It’s just really being that kind of like that servant leadership where you’re really trusting in others, giving all of you in a way that is not in a controlling way.

But there’s so many great resources out there to help you. It’s more of a personal development standpoint that I see that really holds some of us back. Even as CFOs, I see it as well, right? Like you really want a CFO that is a team player and that isn’t going to work, they’re going to want to, like I was saying, you’re going to want someone at a lower level to be able to, if there’s work that they can do, you would want them to do it.

And then you’re developing up that next level of individuals that are going to work up. And then you’re teaching another generation with new ideas, more technology. So there’s just so many benefits of being open to trusting in folks. But again, you have to, there’s a lot of things involved with that, right? Like you have to hire the right people. You have to have a good interview process.

There’s so many things that you could be spending your time on and then you let the CFO worry about financial statements, board reports, metrics, because there’s so many other things in a practice that really, you could be providing more value to.

**Tracy:** Yeah, and I think that speaks to, you mentioned personal development and a little earlier, you talked about the leadership support and I imagine that this is a big part of it, right? Part of being an effective leader is learning where to let go, learning when, how, and to whom delegation and, you know, the listening and learning, which I know physicians and practitioners are very good at. How many years of school do they have? You know, like, so I know that this is already a skill that they possess.

Something that we sometimes notice with our clients is it’s like, oh, I didn’t realize that all this stuff I already do clinically, I can take over here as the business leader, so I don’t have to learn an entirely new skill set. And usually it’s just a matter of saying like, well, you already do that. You already do it with your clinical team. Now you just need to understand the bigger picture of what you wanna do with your business admin team and how are they gonna go and do that?

So, if you’re a listener and you’re going, wow, this sounds really great, but that first six to eight weeks of working with a CFO, fractional CFO sounds I’d rather, you know, poke on needles in my eyes, have faith, because I think that, you know, ultimately this working, I mean, I’m a big fan of fractional CFOs for many businesses, especially for healthcare practices, because, you know, no money, no practice. I mean, that’s just sort of the end of the end of story, right? So to be able to free up your time and energy as a provider to be more strategic with your business and to kind of turn that piece off and go back to providing the highest level of care possible, which is probably why you went into this in the first place, you know.

**Lizette:** Yeah, exactly. Yeah, it’s been, it’s really rewarding to hear some of those patient stories, right? Because as the CFO, you’re kind of always behind the scenes or you’re working with the back office, but this, but really hearing about how the fact that now the front desk now has a good check-in process and they’re confident and comfortable, and so they’ve created a really calming environment for their patients to come in and getting five-star reviews.

That’s what makes a difference. It’s not whether or not some of these metrics that we’ve talked about, but still healthcare organizations are the core of an impact and mission-driven organization. They’re dealing with humans, such an important thing, our health, like if our health isn’t good, that’s like, you know, we can’t do anything else. So it’s such an important job, such an important service that they’re all providing.

So it’s just really a great opportunity to leverage those others around you that have other skills so that you can be left to do what you do best, whether that is seeing patients or coming up with a new way to, um, a new care or I don’t know, but like something that will help you and free you from some of these business things that, you know, is not really what, I don’t know, just something that will help you get to the next level in your practice.

**Tracy:** Yeah. To be at, you know, performing at the top of your licensure. I mean, that should be the goal, really, yeah. Yeah, well, you speak my language. I’ve so enjoyed our conversation. I’m curious if there’s anything that we haven’t talked about that you really wanted our listeners to hear today.

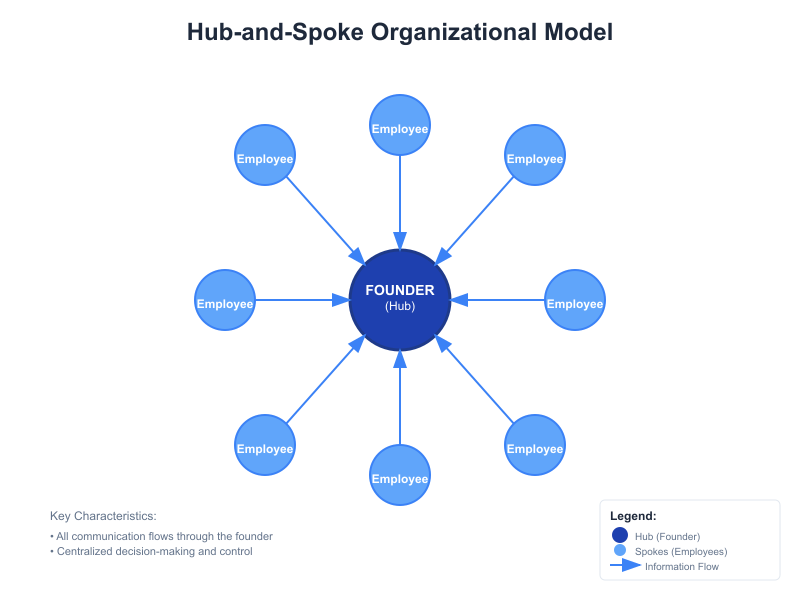

Data Visualization

**Lizette:** One of the things that we’re really excited about at Ascent CFO is our data visualization platform, Insights by Accent CFO, that we’ve been using with some of our clients. And it’s really just a fancy way of simplifying some of these KPIs that, you know, we’ve usually just done in Excel charts and stuff. So we’ve really been able to just make it more fun and exciting, right, to have them clean and simple.

And so if you could check out our website, ascentcfo.com, it talks a little about, a little bit about the data visualization. And I think that is, is important, important because we can get inundated with data and just facts that not everyone likes to see numbers on charts or a list of numbers. So, just trying to find a unique way to present information to business owners and their leadership team.

**Tracy:** An actual visual, right? So, you can literally get a picture of what’s going on.

**Lizette:** Yeah. Like a dashboard that’s just kind of…

**Tracy:** Yeah. I love that. That sounds pretty cool. So you said it, but let’s say it again, where can people find you if they want to learn more about this?

**Lizette:** Yes, they can go to AscentCFO.com. And there’s a link there that you could go to and see our data visualization and also talks about our you know, what we’re excited about and what our expertise is.

**Tracy:** Perfect. We’ll make sure that’s easily clickable in the show notes as well. Lizette Peña, what a wonderful conversation. Your passion is palpable and your commitment to like supporting these mission-driven professionals and helping them, you know, do better at business so they can go back to doing what they do best and providing, you know, the best level of care possible is just really commendable. Thank you.

**Lizette:** Thank you, thank you. It’s really rewarding to do this work. Thank you so much.

**Tracy:** Thanks again for coming on.

Key Takeaways

**Tracy:** I really enjoyed my conversation with Lizette Peña about the positive impact of a fractional CFO and what they can do for your healthcare practice.

My few takeaways from our discussion:

- First, understanding your KPIs, your key performance indicators. From no-show rates to pair mix, it isn’t just about the numbers, it’s about making informed decisions that improve both patient care and practice profitability.

- Second, cash flow management doesn’t have to be overwhelming. Sometimes simple adjustments like strategically timing your vendor payments can make a huge difference in your practice’s financial health.

- And finally, remember that being a great healthcare provider and a savvy business owner are not mutually exclusive, but you don’t have to do it all yourself. Working with professionals like Lizette allows you to focus on what you do best, providing excellent patient care, while having confidence that your business is being strategically managed.

If you’d like to learn more about Lizette and Ascent CFO solutions, you can visit their website at ascentcfo.com. This is where you can check out their innovative data visualization tools that make financial metrics actually enjoyable to review. We’ll see you next time.

—

Improve Your Healthcare Practice’s Financial Health and Profitability

Schedule a confidential consultation with a Fractional CFO today.