Navigating and Preparing for Due Diligence

- Home

- Resource Hub

- Navigating and Preparing for Due Diligence

We’ve previously written about exit planning broadly, and about building a perfect pitch deck more specifically. Now, we come to the step of navigating due diligence. This is one of the final steps to get your deal closed whether you are raising Angel/Seed capital, VC funding, or perhaps completing a sale of your entire business. It’s critical for any company to be prepared and organized before due diligence begins to preserve your agreed-upon valuation and not have to accept less desirable terms as a result. Worst case, lack of preparation could result in the deal falling apart.

The good news, even for a first-time fundraiser/seller, is that you are likely familiar with the concept of due diligence and may have performed some of the steps in a personal capacity. Investing in the stock market, for example, requires analyzing company or fund prospects, to determine if they fit within your investment goals. Investors will undertake an amplified version of this process, often hiring professionals to analyze and dig deep into a company’s operations before making a decision to acquire.

In this post, we dive into the mechanics of due diligence, the ramifications for your business, and explain how to prepare for and navigate the process.

What is Due Diligence?

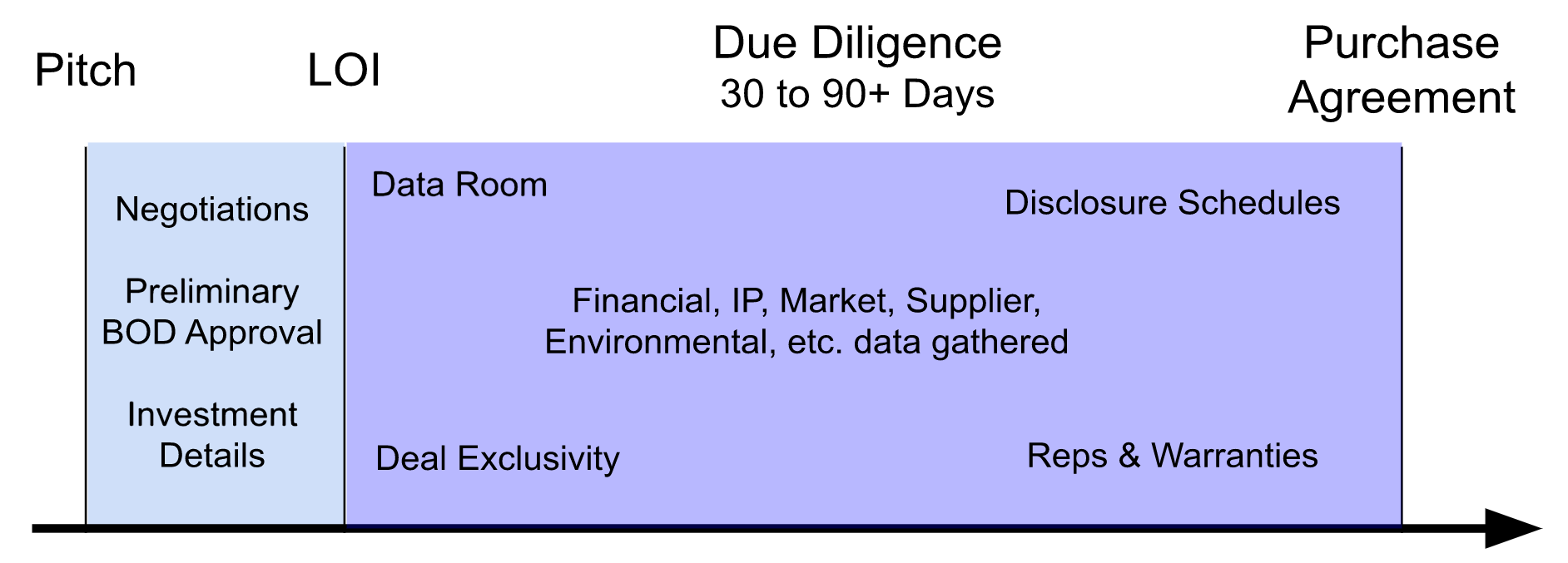

Due diligence is a discovery process in which potential investors or acquirers learn everything they need to determine whether or not a particular company makes sense for their investment portfolio. The process can take anywhere from 30 to 90+ days depending on the scale and complexity of the deal as well as the risk aversion of the buyer.

As illustrated in the example timeline below, due diligence often begins in earnest once you receive a Letter of Intent (LOI), with findings strongly impacting the final deal terms.

We’ll get deep into the details, but for anyone unfamiliar with due diligence it often helps to consider a house buying analogy because the steps of both processes are similar even if the breadth and depth of investigation differ.

Due diligence is most like the inspection phase of buying a house. This is when negotiation occurs as the buyer and seller figure out if the deal is going to work by determining the final valuation and purchase price along with acceptable concessions and warranties.

Types of Due Diligence

In most circumstances, the buyer/investor will direct the due diligence process, and the type of investor greatly impacts the process. For example, a private equity (PE) firm looking to purchase a majority or all of a company is generally going to be more risk-averse than venture capital (VC) or earlier-stage investors. Therefore, they will ask for and review substantially more information.

Understanding the Purchaser’s Perspective

There’s a lot at stake for potential buyers if due diligence fails to uncover serious deficiencies in the company. Not only can a buyer lose their entire investment, but reputational damage could impact future deals and funding. In a stock sale, the buyer inherits the known and unknown liabilities of the acquired company, risking claims or lawsuits from customers, employees, and others that could lead to losses in excess of the actual purchase price.

Due Diligence Categories

Some form of financial due diligence is always a given, but as a business owner, you should also expect data requests and analysis related to:

- Technology/IP

- Customer/Sales/Suppliers

- Material Contracts

- Employment/HR

- Litigation/Legal

- Taxes

- Antitrust/Regulatory

- Insurance

- General Corporate Matters

- Environmental Issues

- Related Party Transactions

- Real estate/Property

- Marketing

- Competitive Landscape

In the case of PE and VC firms, the investor will coordinate and perform most due diligence activities with their in-house staff, but for specialized tasks, it’s typical for them to outsource tax compliance, quality of earnings (QofE), intellectual property, and IT evaluation to an outside firm.

Not all categories apply to all companies, but being prepared helps ensure a smoother process. For example, if your competitive advantage is the result of a patent, expect to provide information about your intellectual property, steps taken to protect it, and potential challenges maintaining it.

Financial Due Diligence

During financial due diligence, your CFO will take a leading role to discuss assumptions that go into your financial models, the evolution of the competitive landscape, and business opportunities that could be capitalized on with additional funding. The stakes are high because findings directly impact your valuation and deal terms.

Investors will expect to see forecasts for:

- Income Statements

- Cash Flows

- Balance Sheets

They will compare your performance during due diligence with your near term forecasts to look for accuracy and trend changes. There is inherent noise in short term results, so sellers benefit by engaging in relationships with potential acquirers early. Investors that are familiar with your business and financial modeling assumptions can discount that early noise, resulting in fewer surprises and a higher likelihood of a successful close.

Expect investors to focus on different metrics depending on your growth stage. This list below is not exhaustive, nor are the columns mutually exclusive; rather, they serve as an example of metrics investors are likely to value.

Earlier stage, Higher Growth:

- Sales & Revenue Growth

- Number of Customers & Growth Rate

- Gross Margin

- Cash Burn

- Customer Acquisition Costs (CAC)

- Monthly Recurring Revenue (MRR)

- Customer Lifetime Value (CLV)

Later stage, Higher Profitability:

- EBITDA / Net Income

- EBITDA Growth

- Discounted Cash Flows

- Net Cash/Debt

- Book Value

It’s true that investors are looking for red flags, but financial due diligence is also an opportunity to get investors excited about your company’s potential. Your pitch presentations and initial financials are what attracted investors; due diligence is your opportunity to back up those claims and demonstrate that your company is as valuable as your pitch implies.

Working Through Due Diligence

The difficulty of the due diligence process is going to be directly proportional to the operational standards of your business.

For example, a CFO that regularly coordinates with the department leads to establish forecasts, which the company reliably meets, can confidently present these projections to an investor. If you have the appropriate business licenses and maintain accurate records of vendors, ingredients, etc., you won’t need to scramble to gather data on the fly, potentially missing material details on your disclosure schedules.

The idea of continuous due diligence is that the information investors need to determine a valuation is the same data you need to successfully operate your business. For example, a company needs to know if its cash flows support near-term working capital, additional staff for growth, and capital expenditures, so it makes sense to have the data available whether you’re answering an investor question or using the data for internal decision making.

Handling Due Diligence Requests

In many ways, due diligence is a conversation where the investors’ goal is to understand your company, and ultimately, what they’re buying. That conversation starts broad and becomes more detailed depending on previous answers. For example, an investor might ask for an ingredient list if you manufacture a consumable product, which could lead to questions about FDA lists and prop 65 compliance. Other questions are designed to establish trends, like changes in revenue or marketing spend over the course of the sale process.

Sharing Information

When it comes to actually sharing company data, efficiency and security are paramount.

Companies typically opt for an online, permission-restricted “data room” that may take the form of a file share on the company intranet or a third-party service for sharing data securely. A secure data room is beneficial as it limits access to those that strictly require the information which in turn minimizes data leaks and loss of proprietary company documents. Anyone with access should be bound by non-disclosure agreements where appropriate and care must be taken to share only what is absolutely necessary.

An organized, online data room should facilitate quick due diligence request turnaround. Documents can be shared, collaborated on, and updated in real-time keeping the overall deal process on track.

Put the Right People in the Right Places

It is important to establish points of contact and review processes when responding to data requests. Data may be gathered by many individuals, but it usually makes sense to funnel communication through just a few people. Your CFO will communicate with investors on financial matters while your HR designee responds to requests about employment contracts, and so on. This ensures a consistent message from your company to the relevant groups, avoiding confusion and delays.

Finally, controlling points of contact is a good way to have an investor begin to build rapport with the key players in your business and get a feel for the company’s organization.

Impact of Due Diligence

Findings from due diligence make their way into a final purchase agreement in multiple ways:

1. Sale price / valuation

Financial due diligence will bring to light sales trends and profit margins that will inform the sale price. It will be the job of your CFO to accurately convey your company’s financial results and forecasts. Due diligence may also give the buyer reason to request certain reductions in sale price based on findings. For example, a tax audit may uncover $50,000 of unpaid state sales taxes and the buyer, who will soon be responsible for that payment, may request a corresponding sale price reduction.

2. Representations, Warranties, and Disclosure Schedules

Representations (reps) and warranties are the claims that you would assert as true in a purchase agreement. If they’re later found to be untrue, it could result in an indemnification claim to make the buyer whole for any loss incurred. As an example, due diligence may find that your company’s success hinges on a critical patent. In that case, the buyer would ask for a rep asserting that the company does indeed own the patent. It’s also likely to specify the ramifications and compensation owed for violating that rep.

Disclosure Schedules are legal attachments to the purchase agreement in which the seller discloses all relevant information about the business to the buyer. Disclosure schedules list company information such as: key contracts, major suppliers, owned assets, IP, ingredient lists, insurance policies, permits, owned property and assets, employee benefits, shareholders, pending litigation, and so on.

Reps and warranties reference disclosure schedules which give the buyer legal recourse should they suffer damages resulting from untrue seller statements. Disclosures also serve to protect the seller by allowing the buyer to enter into a purchase agreement with full knowledge of any potential issues. Thorough disclosure statements take significant time and effort to compile, review, and negotiate, so it is important to begin the process early, expecting subsequent iterations throughout the diligence process.

Impact of due diligence on business operations

The diligence period brings intense scrutiny to business operations as an investor looks for any misalignment between financial forecasts and actual results.

Making significant changes in your business is going to introduce noise in your operating results while investors are looking for any misalignment between your financial forecasts and actual results. For that reason, companies often opt to avoid making material changes (personnel changes, large capital expenditures, etc.) during due diligence. If a change is critical to the business, it may be worth implementing and working through before beginning a sale process.

Also, expect due diligence to take time and effort from your deal team, which can no longer be spent on day-to-day business operations. Not only will your team need to work through diligence requests, but your employees are likely to be distracted by upcoming deal uncertainty. It’s important to proactively communicate expectations and, in some cases, it’s beneficial to offer incentives to key employees to keep them focused on a successful deal close while keeping up with their existing duties.

Due Diligence as a Negotiation Tactic

After receiving an LOI and a deal is agreed to in principle, it’s common to enter into a period of exclusivity where you won’t pursue a deal with other investors.

Exclusivity creates a shift in negotiating power from seller to buyer because due diligence places operational burdens and restrictions on the seller’s company as discussed earlier. It’s common for the offer price to come down based on findings during due diligence, so it is important to pitch to as many potential investors as possible and receive an LOI for a price higher than your desired final sale price.

It’s worth noting, however, that due diligence does offer some opportunities to the seller. Investigating a company takes time and money to hire the appropriate experts and perform analysis. These are sunk costs to the buyer, so that may push marginally skeptical buyers over the edge to a deal close. Naturally, the buyer will attempt to recover these costs by asking for a price reduction based on findings, but the seller is under no obligation to accept those reductions.

It’s critical for the seller to have a backup plan, whether that’s another investor, or being prepared to continue operations as an independent company. Most buyers are happy to acquire a good business at a fair price for a mutually beneficial outcome, but it’s important to maintain negotiating leverage to garner the valuation your company deserves.

Final Thoughts

Many business owners view due diligence as a necessary evil when selling their company or bringing on investors, but it doesn’t have to be. Practicing continuous due diligence keeps you prepared for a sale while enhancing business operations. Up-to-date income statements, cash flow, and balance sheets with corresponding forecasts allow your company to plan for the future.

It often feels like diligence requests and negotiations come down to the wire in any deal, but successful navigation through the process ends with a purchase agreement that marks a new and exciting chapter for you and your company.

Contact Us

Questions or business inquiries regarding our part-time CFO, finance and accounting services are welcome at: info@ascentcfo.com