How to Build the Perfect Pitch Deck

- Home

- Resource Hub

- How to Build the Perfect Pitch Deck

This article is a follow-up to “A Founder’s Guide to Raising Capital” where we discuss how to identify your ideal investors. Now, let’s win them over with the perfect pitch deck.

A pitch deck is a tool that’s used to spark interest. As a founder growing a startup, a pitch deck helps you attract interested investors who could fund and be partners in your business. A pitch deck should leave a strong first impression of you, your company, and the opportunity for the investor, and result in follow-on discussions to explore the funding opportunity in more detail. With a strong pitch deck as the difference between a funding lead and a funding dead end, it is worth an entrepreneur’s time and energy to create a compelling and accurate presentation.

Here are our best tips for building the perfect pitch deck to win over investors, including an emphasis on the financials, which play a critical role in whether or not an investor moves forward. Investors are ultimately asking “is there an opportunity to make substantial money here?” and your financial model forecast helps them answer that question more than any other aspect of your presentation.

We begin with a sample pitch deck outline that details each section of a perfect pitch and presents the content in an order that will spark and build interest. Then, we share additional advice for how to present a strikingly strong financials section to “wow” investors.

The Ideal Structure for a Pitch Deck

The best pitch decks tell a compelling and cohesive story about your company. In general, they include why you started the company, where you are today and why that’s impressive, and where you could be with additional funding. Your narrative should create excitement about the opportunity you’re presenting, but also show the investor that you’ve thought through the critical aspects of your business.

A Sample Pitch Deck Outline

There is no right way to organize your pitch deck. Rather than following a specific outline, your focus should be on constructing a captivating narrative of the business opportunity. However, all investors have specific content in mind that they’re hoping to learn from your presentation (for example, both Sequoia Capital and Techstars templates communicate similar information). This particular outline dives into each piece of important content and organizes it in a way that will set you up to communicate a persuasive story. These aren’t necessarily the individual slides themselves (although they could be), but rather the content that should be built out in your pitch deck. You may need several slides to communicate the information in any given section.

1. Begin with your purpose.

Can you define your company for your audience in a single sentence? Many famous pitch decks began this way. For example, Airbnb’s pitch deck began with “Book rooms with locals, rather than hotels.” LinkedIn’s Series B Pitch began with “Find and contact the people you need through the people you already trust.” Hook your investors with a simple, powerful statement. Try it!

2. Introduce the problem.

Describe the specific pain point that you’re solving that no one else is solving well today. What did the customer do to address this pain point before your company came along and why doesn’t that work? Bring the problem to life by sharing metrics, statistics, or a story to illustrate the problem if you have them. Earlier stage companies will have to spend more time explaining the problem than later stage companies.

3. Communicate your solution.

Describe how your solution makes the customer’s life better. This is where you focus on the specific pain relief you provide the customer, rather than your product’s individual features. Explain what the perfect solution looks like without going into all the details about what you have built. For example, after explaining the limitations of traditional hotels, Airbnb shared that their web platform allows users to save money when traveling, make money when hosting, and share culture via local connections to the city.

4. Present the market opportunity.

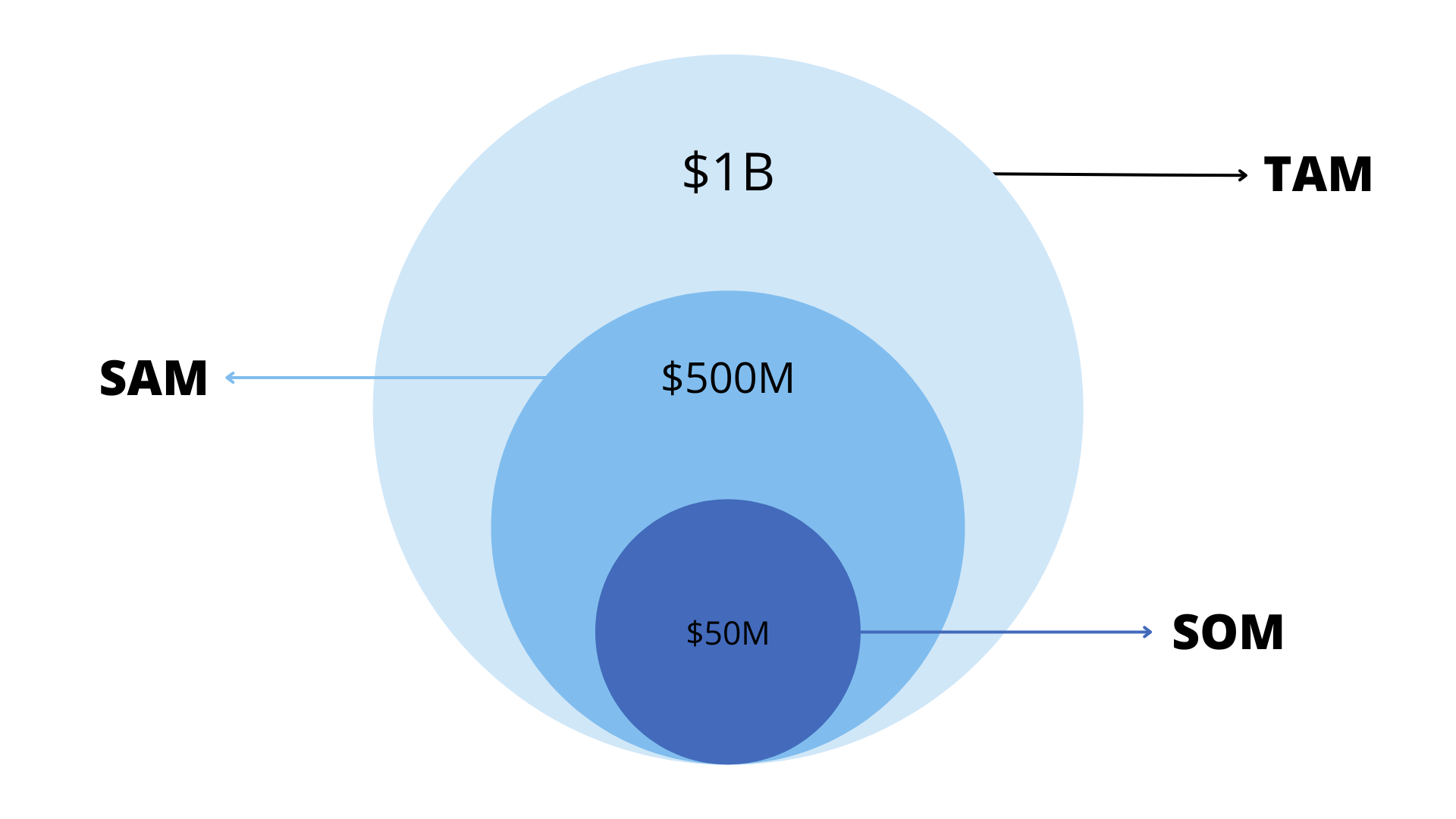

Timing matters! Why is now a good time for your solution? How has your category evolved? Are there recent trends that make your solution possible? How big is the market opportunity? This is where your numbers start to come in. Show investors the Total Addressable Market (TAM) top-down, Serviceable Available Market (SAM) bottom-up, and Share of Market (SOM) so they can understand the size of the opportunity from different angles. All of your numbers should be backed by research and defendable assumptions.

- Total Addressable Market (TAM), top-down, represents the revenue opportunity at 100% market share, as if no competition exists.

- Serviceable Available Market (SAM), bottom-up, represents the portion of the TAM that can be served by a company’s products and services.

- Share of Market (SOM) represents the portion of the SAM that can be realistically served.

Be prepared to share your reasoning behind these numbers. Generalities will give the impression that you don’t really understand the market.

5. Name the competition.

Acknowledge your main competitors and share your competitive advantage over them. What specifically makes you different? Do you have patents or other intellectual property? To build credibility with investors, don’t gloss over your competitors’ strengths. Being honest and realistic about the challenges your company could face demonstrates that you understand the competitive risks and still believe you’re going to win.

6. Share a product demo.

This is a key part of your presentation as investors are eager to see what the product actually looks like. Show the features of your product rather than tell whenever possible. Consider demonstrating your product live or sharing a video. While not as dynamic, images can work too. Whichever method you choose to present your product, make sure the quality is top-notch. If you don’t have a product built yet, a mockup is better than nothing to increase your investors’ confidence.

7. Explain your business model.

How does your company make money? There are many different types of revenue models, everything from Software as a Service (SaaS), to selling a physical product, to services businesses and more. Which one does your company utilize and how? What is your pricing model? If you have compelling metrics, share them. For example, you could share the average account size and/or lifetime value of your customers here if they will impress investors.

8. Describe your sales and distribution model.

Give investors a sense of how you sell (or plan to sell) your product and how you will get it into the hands of your customers. Do you sell online or in stores? What kind of stores? If you’re not already up and running, what is your go-to-market strategy? How do customers learn about you?

9. Hype your team.

Tell investors why your team is the right group to make this happen. Who are your founders and key executives and why is their background relevant to the success of the business? Who is on your Board of Directors or Board of Advisors?

Co-founder of LinkedIn and venture capitalist Reid Hoffman warns that “one common mistake is putting the team slide early in the deck. The team behind your idea is critical, but don’t open with that.” He explains that the first 60 seconds of your pitch is when you have the most attention from your investors, so you should use it to open with your investment thesis – what prospective investors must believe in order to want to be shareholders of your company. Once you’ve shown why the opportunity is intriguing, you can introduce the team that will be able to execute the ideas and make the company successful.

10. Present your financials.

For the purposes of a pitch deck, your financials should give the investors a chance to evaluate whether or not you are financially literate and have an intelligent view of your business model. They aren’t digging into all of the financial details right now because your assumptions can later be validated by due diligence.

Show your historical traction.

If you’ve already launched your product, here are some key performance indicators and financial statements you can share with investors to give them a sense of the progress and current health of the business.

- Customer counts (including presales)

- Conversion metrics

- Average revenue per customer

- Year-over-Year (YoY) Growth

- Customer growth by month or quarter

- Customer acquisition costs over time

- Customer Churn Rate, also known as the Rate of Attrition

- Customer Lifetime Value (CLV)

- Income Statement, also known as the Profit and Loss Statement (P&L)

- Balance Sheet

- Cash Flow Statement

Communicate your financial projections.

Investors understand that financial projections are a guess, but it is important that they are an entrepreneur’s best guess. Investors see “hockey stick” projections all the time, so they’re not necessarily going to be impressed by a high growth rate. In order to win over investors, you should be prepared to discuss (and defend) the underlying assumptions that you’ve made to arrive at your projections and what your key expense drivers are.

Your underlying assumptions come from your financial model. A financial model is a tool that allows you to plug and play with different numbers and stress-test different assumptions to see what the resulting growth is in your business. The most comprehensive financial model is the 3 Statement Financial Model because it integrates the income statement, balance sheet, and cash flow statement into one dynamic model. We recommend this model because it will allow you to see the ripple effects throughout your entire business. As a result of building and engaging with a financial model, you can more confidently determine the best path forward for which assumptions you should accept and present in your 3-year rolling forecast model.

A 3-year forecast will give investors information about how and when they can expect a return on their investment. Many companies only focus on forecasting their profit and loss (income and expenses), but balance sheet and cash flow projections are also important. Profit and loss does not tell a complete story. The reality is, you can be profitable but still run out of cash, and investors know that. By projecting cash flows, you can increase your investors confidence in your ability to grow the business without growing yourself out of business.

In a future article, we will dive further into the importance of financial models.

Share your capitalization table.

A capitalization table (or “cap table”) tells investors who currently owns the business and how much they own. It will include a list of all the securities your company has issued, including stock, convertible notes, warrants, and equity grants, and who owns them. Investors want to see that the founders and key employees own enough of their company to stay motivated and have enough equity to attract new employees as well. Investors also want to make sure there’s enough equity to support new investors in future rounds of funding.

11. Deliver the call to action.

At the end of the day, making your pitch deck is a marketing effort, and like most marketing it will end with a call to action. A call to action can also be something as simple as asking if you could reconnect in 6 months to describe your progress, at which point you may be looking to raise capital. Most often, entrepreneurs ask prospective investors to participate in a business opportunity by asking for X dollars in exchange for Y% stake in their company.

If you’re pitching for funding, it’s very important to make the right ask given your current valuation and your exit goals. Once you’ve settled on the right ask, consider showing a timeline of how you would spend the money to achieve specific milestones. Investors want to see you have a plan for how you’re going to use their money to grow the company.

Concluding Your Pitch

It’s important to end on a slide that you want your audience to pay attention to. Rather than ending on one that says “Q&A” or “Appendix”, remind investors why they should want to be stakeholders in your company. Consider returning to the powerful one-line statement about your company that you opened with. An appendix section in the pitch deck is optional. These slides would either contain additional information or address objections. If you anticipate that your investors will have certain questions after your presentation is over, it’s a good idea to go ahead and prepare these supplemental slides.

In general, your pitch deck should guide the conversation, anticipate the investors’ objections, and lead to questions that you’re prepared to answer. Don’t be afraid to say “I don’t know” to unexpected questions, but you need to be prepared to talk about everything in your deck in detail and be able to justify your numbers with smart assumptions.

Why Put the Financials Near the End of the Pitch Deck?

There are two fundamental reasons to put financials at the end of your presentation:

- Financials scattered throughout the presentation can derail your story

- Your pitch will likely end with a call to action to provide financing

As soon as you show an investor a set of numbers, they’re going to start creating their own story about your company, whether they fully understand it or not. By leaving financials to the end, you’ve had the opportunity to educate your investor, and you maximize your chances of the investor putting those numbers in the context of your unique business.

By the time you reach the financials, your audience should be familiar with your company, qualitatively understand the business opportunity, and have some confidence that you have the right business model and team to implement your solution.

That being said, it is perfectly acceptable and expected to supply numbers and data earlier in the presentation when discussing the size of your market opportunity, for example. You can also show high-level financials if they facilitate the rest of your pitch. For example, compound annual growth rate (CAGR) of revenue, units delivered, registered users can help a prospective investor understand how your product is resonating with customers.

Overall, using financial metrics sparingly until the end will keep your audience focused on your vision as you build the appropriate context.

The Role of a CFO in Preparing the Perfect Pitch Deck

Entrepreneurs have an opportunity to stand out in the crowd when they have clear and compelling numbers in their pitch deck. According to DocSend, investors spend more time looking at the financials slide than any other slide in the pitch deck.

Not all entrepreneurs are great with numbers. More often, their exceptional strengths are in a variety of soft skills such as communication, networking, business storytelling, and creativity. Entrepreneurs start companies because they are passionate about the problem they are trying to solve, not because they want to work more closely with financial statements. However, a strong understanding of the financial aspects of a company is absolutely critical to its success in any stage. This is where a good CFO comes in.

Your CFO can help you prepare the fundamental financial aspects of your presentation, including:

- Current data – sales, cash flow, user registrations, deliveries, etc, as a snapshot in time to demonstrate your traction

- Forecasts – a rolling 3-year financial forecast model that gives investors a benchmark with which to measure your operations going forward

- Supporting assumptions – explanations establishing credibility for your forecasts

- Sources/uses of funds – expectations for future rounds of fundraising by showing how the business generates and spends money

- Alignment of your company’s valuation with your financing/partnering ask – how much investment to ask for given the current value of your company and your growth and exit goals

A financial professional such as a CFO may not be the first person a founder thinks to reach out to for help on their pitch deck, but given the importance of the financial aspects of the pitch, it’s a good idea for entrepreneurs to make sure they have the support they need to present accurate data and defendable projections. Fractional CFOs, CFOs that work on a part-time and/or project basis, are a great option for start-ups that can’t yet support a CFO full-time.

Furthermore, by engaging a CFO from the beginning, entrepreneurs can ensure that the financials they present in their pitch deck match the financial documents they provide during the due diligence process, laying a solid foundation for more investor conversations and the company’s growth.

Contact Us

Questions or business inquiries regarding our part-time CFO, finance and accounting services are welcome at: info@ascentcfo.com