Resource Hub

- Home

- Resource Hub

Tags:

- Acquisition

- AI

- Artificial Intelligence

- Ascent CFO

- Buy-Side M&A

- capital strategy

- cash flow

- CPG

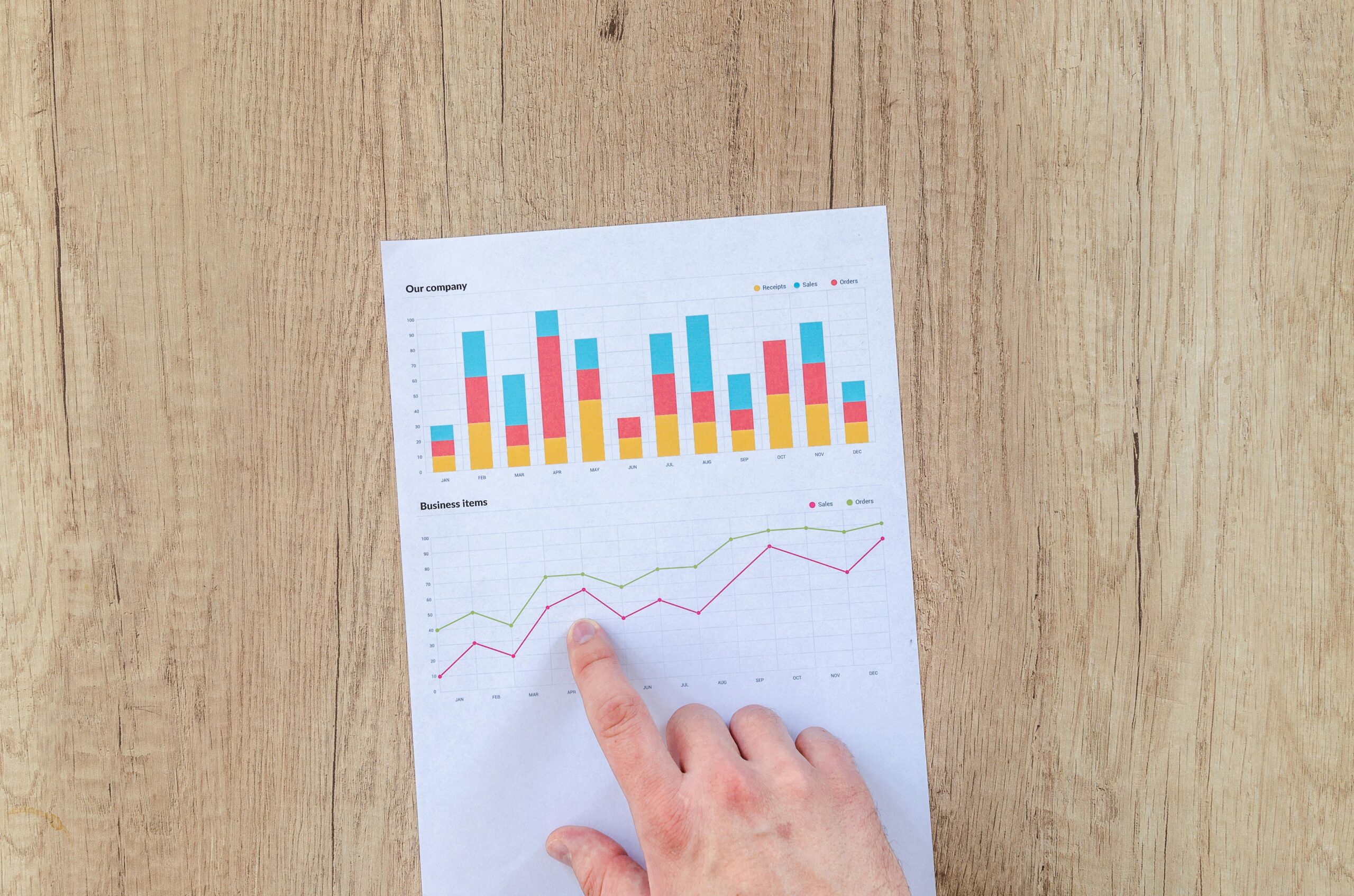

- Data visualization

- Denver Startup Week

- Diligence Process

- Due Diligence

- ecommerce

- Exit Planning

- Financial model

- Financial planning

- Financial reporting

- Financial strategy

- forecasting

- Fractional CFO

- Free Tools

- Fundraising

- growth strategy

- Healthcare

- Insights by Ascent CFO

- Interim CFO

- Interim Services

- Investors

- KPIs

- M&A

- News

- Private Equity

- SaaS

- SaaS Metrics

- Scale Up Series

- Spotlight

- Start-ups

- Technology

- Uncertain Market Conditions

- uncertainty

- Unicorns

- Venture Capital

- Virtual CFO

- Year In Review

- year-end planning

LinkedIn